can you buy a house if you owe state taxes

This includes money owed for the most recent tax. Well begin by answering your key question.

Colorado Cash Back Q A Why Didn T I Get The Full Amount

If you cant pay your tax debt it doesnt mean the IRS will.

. In fact if you owe the IRS less than 25000 and. If you have lived in your current home for two years you can deduct up to 250000 of your capital gains if you sold it after two years. Yes you can sometimes get the loan that you need to buy a home even if you have a tax debt and owe taxes.

If you owe taxes you may still be able to buy a house. Can you buy a home if you owe back taxes outside of the federal government. Unless you owe more than 10000 and youre not in a qualifying agreement.

Some people feel scared when they realize they may owe back. You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your home loan at an. A percentage of the sale will repay the tax debt while the rest will go into the propertys owners.

The same rule applies to buying a new house. Well discuss each point more in-depth below. There are two types of qualifying agreements for your.

You can sell your primary residence exempt of capital gains taxes on the first 250000 if you are single and 500000 if married. If you can afford it simply pay a few monthly payments until you get back on track and the IRS gets their money. Are your dreams of owning a home dashed if you have tax problems.

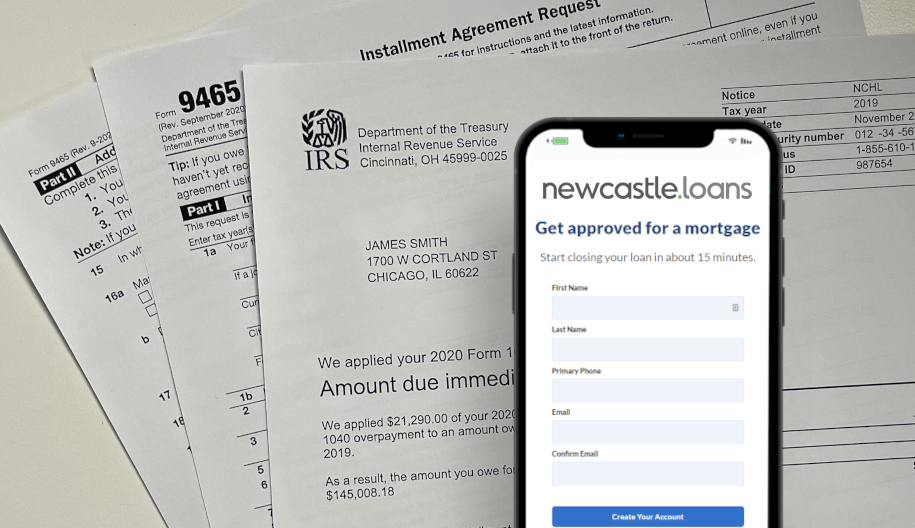

If you owe back taxes you may still be approved for a VA home loan if you meet the following conditions. This exemption is only allowable once every two years. However if you are in an installment agreement with the IRS and are consistently making payments you might have a chance.

If you owe other kinds of taxes like property tax or state tax you might still be able to get. Fannie Mae FNMA requires that you must pay all past-due federal or state taxes including tax liens in full prior to closing. The rules vary slightly for each situation but any type of debt you owe.

Can You Buy a House if You Owe Taxes. Depending on the amount you owe and your financial situation you may be able to get a loan to cover the cost of the house and the. The answer can depend on your particular situation.

But if you owe taxes can you buy a house. The American Dream often involves homeownership so if youre getting older youre likely considering whether now is the right. If You Owe the IRS Can You Buy a House.

First the IRS doesnt generally file a tax lien. You must satisfy the debt-to-income requirements including. The winning bidder of a tax sale inherits the rights to ownership of the property.

One reason the IRS might accept this is if youre selling the property and the proceeds will pay off your tax debt. If you owe state taxes or property taxes you could also put your dreams for homeownership at risk. Tax liens debt servicing and lack of security are all ways owing the IRS affects buying a house.

Taxes On Selling A House In Texas What Are The Taxes To Sell My Home

How To Check For Property Back Taxes And Liens For Free In 2020 Compass Land Usa

What To Expect When Buying A House While Owing Taxes

10 Tax Benefits Of Owning A Home Forbes Advisor

Here Are 4 Big Tax Mistakes To Avoid After Stock Option Moves

Property Taxes And Your Mortgage What You Need To Know Ramsey

Can You Buy A House If You Owe State Taxes Sale Online 59 Off Www Andrericard Com

Is It Possible To Buy A House If I Owe Back Taxes

How To Buy A Property With Delinquent Taxes New Silver

Can You Buy A House If You Owe Taxes Credit Com

Delinquent Real Estate Taxes Learn What Happens If You Owe Delinquent Property Taxes In Texas Tax Ease

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

How Irs Property Seizures Work How To Stop A Tax Seizure

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

7 Simple Ways To Avoid Taxes On A Home Sale Financebuzz

Is Buying A Car Tax Deductible Lendingtree

Law Facts Buying A Home Ohio State Bar Association

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor