is nevada tax friendly for retirees

The friendly people wide-open spaces and exciting cities like El Paso and Dallas make Texas a great place to retire. A Fairly Retiree-Friendly Tax System.

Aloha State Makes Least Tax Friendly List Maui Now

Thinking the states warm climate offers a perfect retirement destination.

. Vet Friendly Employers. Low Tax Burden. That combined with a 059 percent property tax enables more residents to stay in their homes.

The Most Tax-Friendly States for Business. Additionally there are local sales tax rates that average 28. Nevada offers a property tax exemption to any honorably discharged resident veteran with a service-connected disability of 60 or.

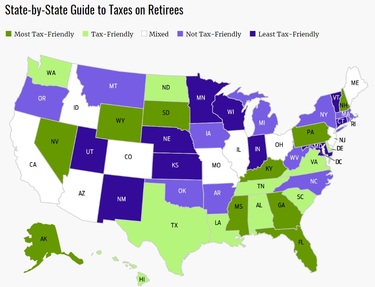

The homestead program allows for a 20000 exemption on property for those 65 and older. Tax free for for retirees over 65 disabled retirees over 62. Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least.

In addition plenty of retirees have found senior living in Nevada attractive. State income taxes are low ranging from 1 percent to 6 percent and the average state and local sales tax rate is 701 percent. You will find people are pretty friendly in this state.

The average combined state and local tax rate in Nevada is 79 Food is exempt. NO Here is a breakout of some specific taxes on day to day items. Theres plenty to do here with various hotels golf courses casinos and restaurants.

Seniors also enjoy a sizable deduction of 31110 per individual for other retirement income types such as IRA 401k and pension income. The state sales tax is under 5 although county taxes can drive that number up beyond 8. The state sales tax rate is 56 which is fairly normal.

No state income tax. Sales and excise taxes in Florida are above the. Boulder City has a tax burden.

Paying the median home price is out of reach for some retirees. This popular snowbird state features warm temperatures and a large population of retirees. Food is a major expense for seniors but Arizona doesnt tax the sale of groceries.

Perscription drugs are exempt. States With No Income Tax Eight states dont impose an income tax on earned income as of 2021. The state income tax rate ranges from 3 to 65 percent and those 65 and older may exclude the first 8000 of retirement income.

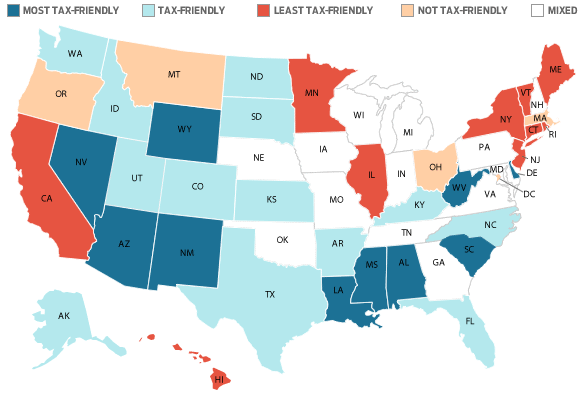

Three main types of state taxesincome tax property tax and sales taxinteract to determine the most tax-friendly states if youre retired or youre about to retire. Its become a hub for retirees with 357 of the population over the age of 65. On the other side of Nevada against the Arizona border lies Mesquite.

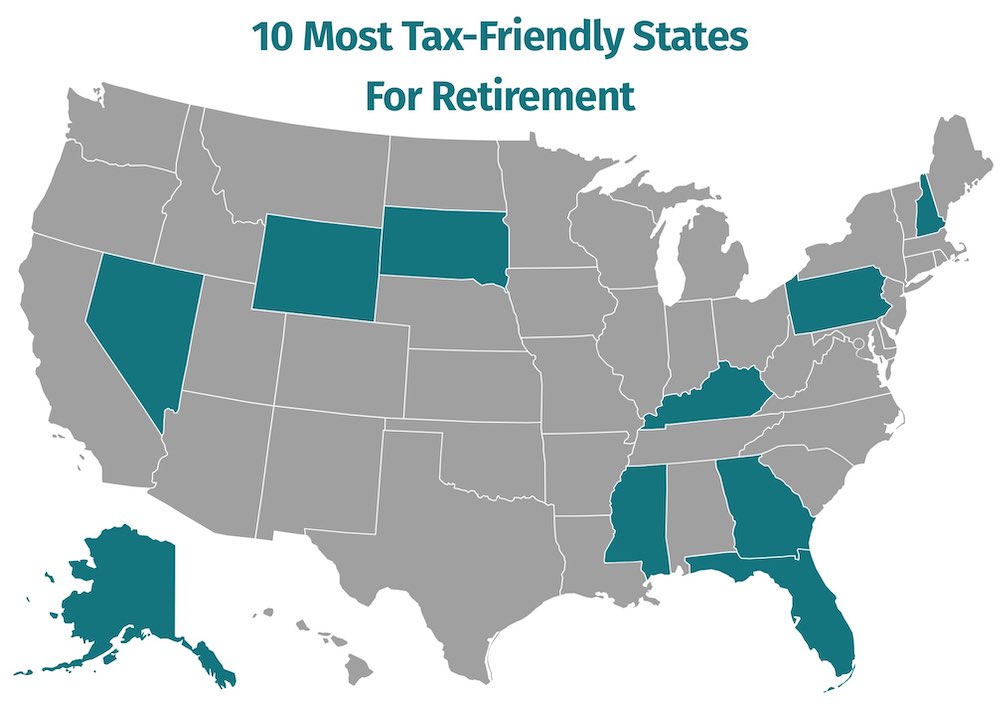

Overall Rating for Taxes on Retirees. Nevada has no income tax and property taxes are low. First off Social Security income is fully exempt from taxation.

That means a retiree living in Arizona will pay a total sales tax of 84 on average. Georgia has no estate tax and no inheritance tax. It seems like every few weeks or so someone publishes a new list of The Best Places to Retire.

Kentuckys tax system generally suits retirees due to several reasons. Localities can add as much as 56 to that but the average combined levy is 84 according to the Tax Foundation. South Dakota has no individual income tax and this is the other state without a corporate income tax or gross receipts tax.

Florida is also friendly for retirees due to the fact that Social Security retirement benefits pension income and income from an IRA or 401k are all untaxed. I dont mean to bore you with financial stuff. 29 cents per gallon.

Laughlin maintains a tax burden of 166. Dave Hughes new book The Quest for Retirement Utopia will help you clarify which criteria are. Average state and local sales tax.

Nevada Department of Taxation. But lets discuss the tax advantages of living in Nevada. In Nevada there is a tax of 0516 on Gasoline.

The tax on cigarettes in Nevada is 0800 which translates to 80 centspack of 20. Florida also has no estate or inheritance tax and sales tax rates are close to national marks. Wyoming has no individual income tax and its one of only two states that doesnt levy a corporate income tax or a gross receipts tax.

Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming.

Nevada Tax Advantages And Benefits Retirebetternow Com

7 States That Do Not Tax Retirement Income

The Most And Least Tax Friendly Us States

Retiree Tax Map Reveals Most Least Tax Friendly States For Retirees Senior Living Proaging News By Positive Aging Sourcebook

Top 10 Most Tax Friendly States For Retirement 2021

The Most Tax Friendly States To Retire

Nevada Retirement Tax Friendliness Smartasset

These Are The Best And Worst States For Taxes In 2019

Tax Friendly States For Retirees Best Places To Pay The Least

Nevada Retirement Tax Friendliness Smartasset

Study Reveals Most Least Tax Friendly States How California Compares Ktla

Nevada Retirement Tax Friendliness Smartasset

Tax Friendly States For Retirees Best Places To Pay The Least

State By State Guide To Taxes On Retirees Kiplinger Green Is Tax Friendly Purple Is Not Tax Friendly Retirement Retirement Locations Retirement Advice

Nevada Is No 2 Among The Most Tax Friendly States Livewellvegas Com

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement

Best Worst States To Retire In 2022 Guide

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax